Improve Your Credit. Unlock Your Financial Freedom.

Credit improvement made simple, effective, and affordable – with experts you can trust.

Myth:

They say bad Credit Score can not be improved.

Truth:

At CrediCA.in, we’ve been helping people rebuild their credit scores for over 10 years.

Credit Score Improvement Services

of experience

About Us

Improve Your Credit. Unlock Your Financial Freedom.

Established by experienced banking professionals in 2018, A Unit of Provision Consulting Services is dedicated to transforming lives by restoring credit health."Empowering individuals to regain their financial stability and confidence.”

“Creating a financially literate community with enhanced credit awareness.”

Credit Services

Certified Counselors

How do our Credit Improvement Services Work?

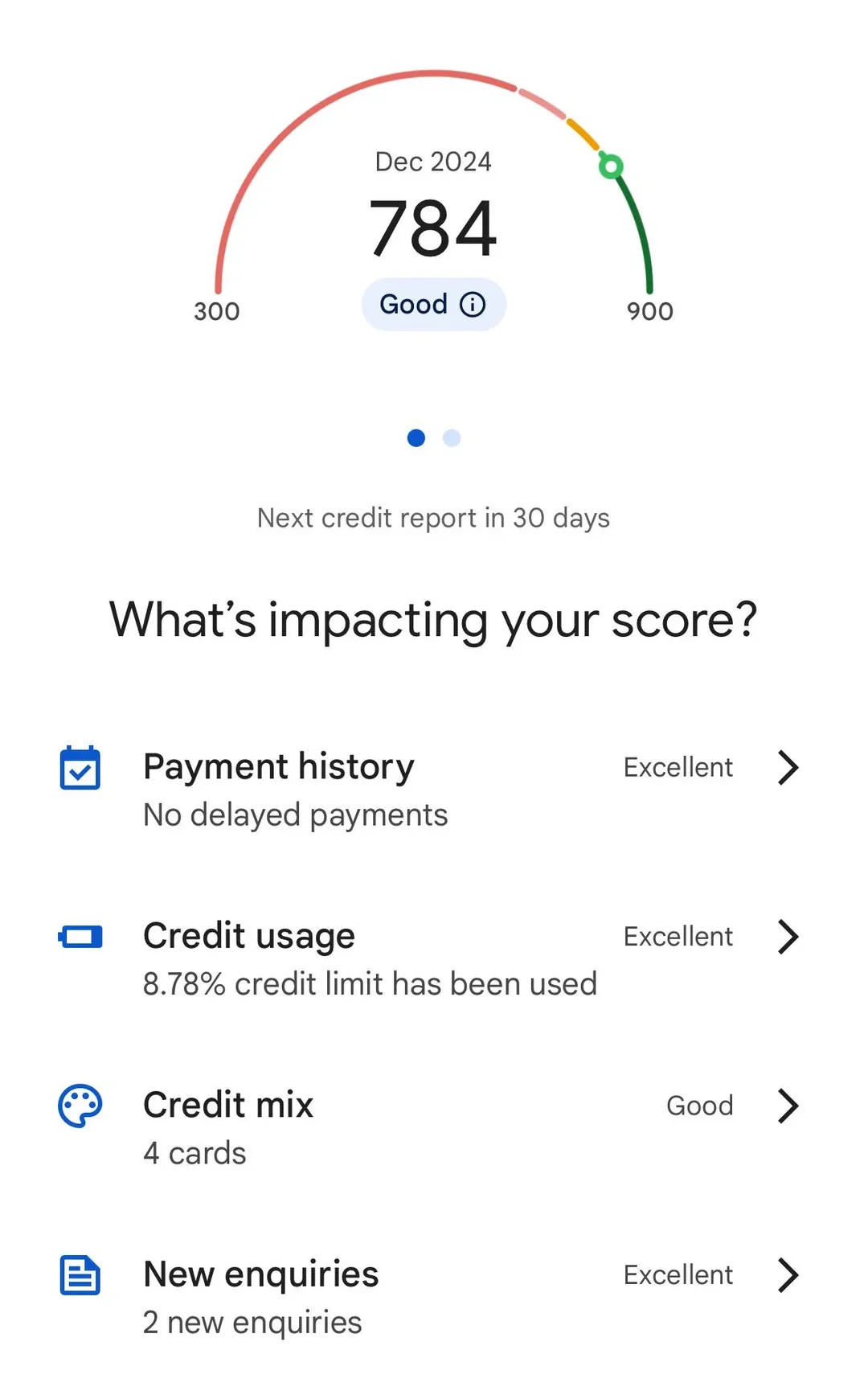

We Analyze Your Credit Report – Know Where You Stand

At CreditCA.in, we take the guesswork out of your credit journey. Whether you're dealing with low scores, defaults, or just want to improve your credit profile, our expert Credit Report Analysis gives you clear, actionable insights — and helps you check your credit score online for free.

What Our Credit Report Analysis Can Do for You:

-

Understand exactly what’s impacting your credit score

-

Discover proven ways to improve your credit score faster

-

Learn how to take full advantage of a good credit score

-

Get step-by-step guidance on rebuilding credit after default

-

Know how to obtain your free credit report the right way

Our credit professionals provide personalized advice and a roadmap tailored to your financial goals — so you can build a stronger credit profile and secure better loan opportunities.

We Resolve Issues That Impact Your Credit Score

Inaccuracies in your credit report can significantly lower your credit score — making it harder to qualify for loans, credit cards, or favorable interest rates. At CreditCA.in, our dedicated Credit Experts work closely with you to identify and correct these errors, helping you restore and strengthen your credit profile.

Common Credit Report Errors We Help Fix:

-

Identity Errors – Wrong name, PAN number, or outdated address

-

Loan Account Inaccuracies – Incorrect account status, late payments wrongly reported, or duplicate accounts

-

Balance & Limit Discrepancies – Incorrect credit limit or outstanding balance

-

Data Reporting Mistakes – Misreported loan closures, repayment issues, or defaults that have already been settled

Personalized Credit Improvement Program

Beyond just dispute resolution, our experts at CreditCA.in design a customized credit improvement plan tailored to your financial situation. We don’t just fix your report — we help you build a healthier credit profile for long-term financial success.

We Recommend the Best Solutions Tailored to Your Credit Profile

At CreditCA.in, we understand that every credit journey is unique. That’s why our expert team evaluates your credit profile and recommends the most effective solutions to address your specific credit challenges.

A strong credit profile not only improves your chances of loan approval but also ensures faster processing and better interest rates — without the hassle.

Personalized Solutions for Every Credit Need:

-

Strategies to improve your credit score after a default

-

Assistance with credit history checks and analysis

-

Expert tips for first-time loan applicants to build and boost credit scores

-

Support for those seeking instant personal loans with quick approvals and minimal risk

No matter your financial goal — whether you're rebuilding, improving, or starting fresh — we have the right solution for you.

See Your Credit Score Now

Get Your Credit Report For FREE

Bank likes to know, your credit score before lends you loans or credit card.

Check your credit score for FREE.

Services for you

Credit Counseling

Loan Settlement

Improvement Loan

Credit Report Correction

Meet Our Team

Our Creative Team

Labore et dolore magna aliqua ute enim addmin veniam and the nostrud ullamco laboris and the nisiut aliquip exea commodos.

Md Nadim Khan

Managing Director

Labore et dolore magna aliqua ute enim addmin veniam and the nostrud ullamco laboris and the nisiut aliquip exea commodos.

Ovai Mujhe Maro

Managing Director

Labore et dolore magna aliqua ute enim addmin veniam and the nostrud ullamco laboris and the nisiut aliquip exea commodos.

Md Noman Khan

Managing Director

Testimonials

What our clients say

“With a low credit score, no one was ready to give me a loan. CreditCA.in helped me get an improvement loan that not only covered my small debts but also helped me rebuild my score. Now I qualify for better offers and feel confident again.”

Swati Patel

Ahmedabad

“I was overwhelmed with my finances and had no idea where to start. The credit counseling I received from CreditCA.in was eye-opening. Their expert patiently explained everything and gave me a clear action plan. I'm now in control of my spending and on the path to financial stability.”

Neha Sharma

Mumbai

“There were multiple errors on my credit report that were dragging down my score. The team at CreditCA.in took care of everything — from identifying the errors to getting them corrected with the credit bureau. I saw a 60-point jump in just 2 months!”

Mohit Sinha

Bengaluru

WHAT IS CREDIT REPAIR CONSULTANCY

DEFINITION

PURPOSE

PROCESS

BENIFITS

Check Your Free Credit Score Now

Contacts

Send a message

FAQs

Yes! With the right strategy, tools, and support, you can significantly improve your credit – regardless of where you're starting.

Many clients see improvements within 30–90 days, depending on the situation.

Absolutely. We follow all legal guidelines, including the Fair Credit Reporting Act (FCRA) and Credit Repair Organizations Act (CROA).

Get free Credit Score and Credit Report Online Now

Our Insights & Articles

Personal Loan vs Credit Card Loan: ...

Introduction Both are unsecured loans But usage and terms differ What is a Personal Loan? Fixed tenure Lower …

How to Improve Your CIBIL Score ...

Introduction Importance of a good CIBIL score Impact on loans and credit card approvals 1. Check …